Travel Insurance Emergencies: What to Do When Things Go Wrong Abroad

When you're far from home and something goes wrong—like a sudden illness, a lost prescription, or an accident—travel insurance emergencies, unexpected health or travel disruptions that require immediate financial or medical support while abroad. Also known as overseas medical emergencies, these situations demand quick decisions and clear knowledge of what your policy actually covers. Most people buy travel insurance thinking it’s just for lost luggage or flight delays. But the real value kicks in when you’re in a foreign ER, stranded without meds, or stuck in a hotel because you can’t fly home.

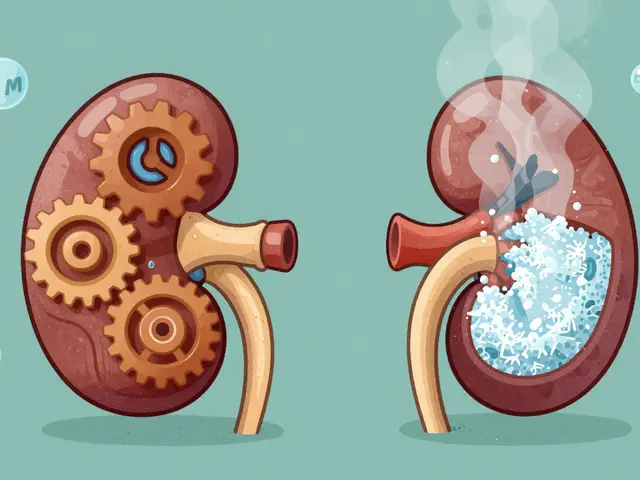

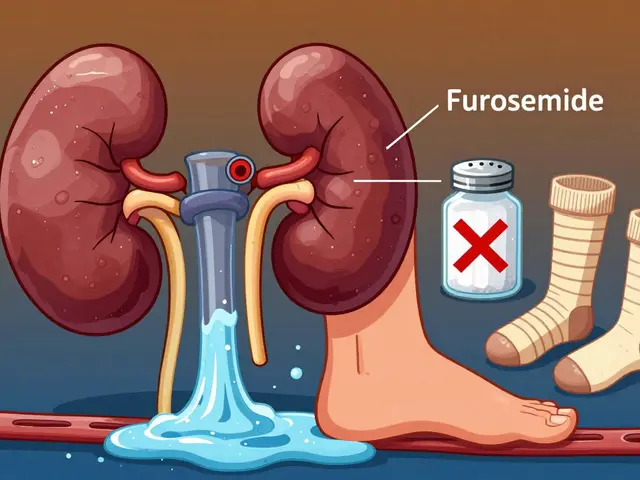

True travel medical emergencies, acute health events requiring urgent care outside your home country—like a kidney stone in Bangkok, a heart palpitation in Rome, or an allergic reaction in Mexico—are covered by good policies. But not all policies are equal. Some only pay if you’re hospitalized. Others won’t cover pre-existing conditions unless you bought a waiver. And a lot of them won’t help you refill a prescription unless you can prove you ran out through no fault of your own. If you take daily meds for blood pressure, diabetes, or thyroid issues, you need to know exactly what your plan does (and doesn’t) do in these cases.

trip interruption, a sudden change to your travel plans due to illness, injury, or family emergency is another big one. Say you’re halfway through your two-week trip and your mom has a stroke back home. A solid policy will cover the cost of your return flight, plus any non-refundable hotel or tour fees you lose. But if your policy doesn’t include this, you’re out of pocket—sometimes thousands of dollars. And don’t assume your credit card’s travel insurance is enough. Most card benefits cap coverage at $1,500 and won’t cover prescription refills or emergency medical transport.

And then there’s the overseas health care, medical services received in a foreign country, often with different standards, languages, and billing systems. In some countries, hospitals expect cash upfront—even for emergencies. If you don’t have direct billing through your insurer, you’ll pay out of pocket and then file a claim. That’s stressful when you’re sick. Good travel insurance gives you a 24/7 hotline that can arrange payment, translate for you, and even help you find a doctor who speaks English. That’s not a luxury—it’s a lifeline.

What you’ll find below are real, practical guides based on actual cases: how to refill your meds overseas, what to do if you’re denied care because of a pre-existing condition, how to file a claim after an accident abroad, and which policies actually pay out when it matters. These aren’t theoretical tips. They’re lessons from people who got caught off guard—and figured out how to fix it. Whether you’re traveling for a week or a year, knowing what to expect before you go can save you money, time, and real pain.

Travel Insurance for Medication Coverage and Emergencies: What You Really Need to Know

Travel insurance can cover emergency medications abroad - but not your regular prescriptions. Learn what’s included, how to file claims, and which providers actually deliver when you need them most.

view more