Imagine this: you’re on a trip in Florida, you twist your ankle badly, and the doctor says you need antibiotics and painkillers. You head to the pharmacy, hand over your insurance card, and expect it to cover the $1,200 in meds. But it doesn’t. Why? Because your travel insurance doesn’t cover maintenance meds - and you didn’t realize that until now.

This happens more often than you think. Travel insurance isn’t just about lost luggage or flight delays. For people who take regular medications, it’s about avoiding a financial disaster overseas. The truth? Most standard health plans - even Medicare - won’t cover your prescriptions abroad. And if you’re visiting the U.S., a single day in the hospital can cost $5,000. Medication costs add up fast. Without the right travel insurance, you could be stuck paying thousands out of pocket.

What Travel Insurance Actually Covers for Medications

Not all travel insurance is the same. The good ones cover new, unexpected illnesses or injuries that happen during your trip. That means if you get sick with the flu, develop pneumonia, or have an allergic reaction, your policy will pay for the meds you need - antibiotics, inhalers, painkillers, even IV fluids if needed.

But here’s the catch: it won’t cover your daily blood pressure pills, thyroid meds, or insulin if you forgot your supply. These are called “maintenance medications,” and every single travel insurance plan excludes them. You’re expected to bring enough for your entire trip - plus a little extra in case of delays.

Most policies offer medication coverage between $5,000 and $250,000 per trip. But that’s not the whole story. You also have to deal with deductibles (often $250), co-insurance (you pay 20% after the deductible), and a 90-day limit per prescription. So even if you get a new prescription while abroad, you can’t get refills beyond that window unless you return home.

How It Works: The Real Process

You can’t just walk into a pharmacy in the U.S. with a prescription from the UK or Canada. U.S. law requires a doctor licensed in the U.S. to write the prescription. That means if you get sick, you need to see a local doctor first - not just show up at CVS with your old bottle.

Here’s the step-by-step:

- Visit a U.S.-licensed doctor or clinic. Many travel insurance providers have telemedicine services now - you can video call a doctor from your hotel room and get a prescription emailed to a pharmacy.

- Take that prescription to a network pharmacy (CVS, Walgreens, Rite Aid). If you’re with IMG, Seven Corners, or Allianz, they’ll have direct billing set up.

- If the pharmacy isn’t in-network, pay upfront. Keep every receipt - the name of the drug, dosage, price, and pharmacy stamp.

- Submit your claim through the insurer’s app or website. Include the doctor’s note linking the meds to your new illness.

- Wait 7-14 days for reimbursement. Some providers like Seven Corners process claims in under 5 days if everything’s in order.

Travelers who follow this process have a 92% approval rate. Those who skip the doctor or try to use foreign prescriptions? 67% get denied.

What’s NOT Covered - And Why People Get Screwed

The biggest mistake? Thinking your travel insurance will refill your regular meds.

One Reddit user lost $300 trying to refill his blood pressure pills after misplacing his bottle. The claim got denied because it was a “pre-existing condition.” Another traveler in Thailand got sick with food poisoning and needed anti-nausea meds - covered. But when he asked for his antidepressants to be refilled? Denied. Again - maintenance meds.

Consumer Reports found that 43% of denied claims come from people misunderstanding pre-existing condition rules. If you’ve been taking a drug for more than 6 months, it’s considered pre-existing. Even if you’re stable, even if you’ve never had a problem - it’s still excluded.

And here’s another trap: credit card travel insurance. Many people think their Visa or Mastercard covers them. It doesn’t. Most card policies cap medication coverage at $1,000, with $500 deductibles. That’s not enough for a serious illness.

Who Needs This the Most?

People over 55 make up 48% of all medication-related claims - even though they’re only 32% of travelers. Why? Chronic conditions. Diabetes. Heart disease. Arthritis. Asthma. These aren’t rare. They’re common. And they require daily meds.

Also, anyone going to the U.S. needs this. Healthcare there is the most expensive in the world. A simple ER visit for an infection can cost $5,000. Add antibiotics, IV fluids, and follow-up care? You’re looking at $10,000+. That’s why North America makes up 35% of the global travel insurance market.

And if you’re a frequent traveler? You’re not just protecting yourself - you’re protecting your family from having to pay your medical bills.

Top Providers and What They Offer

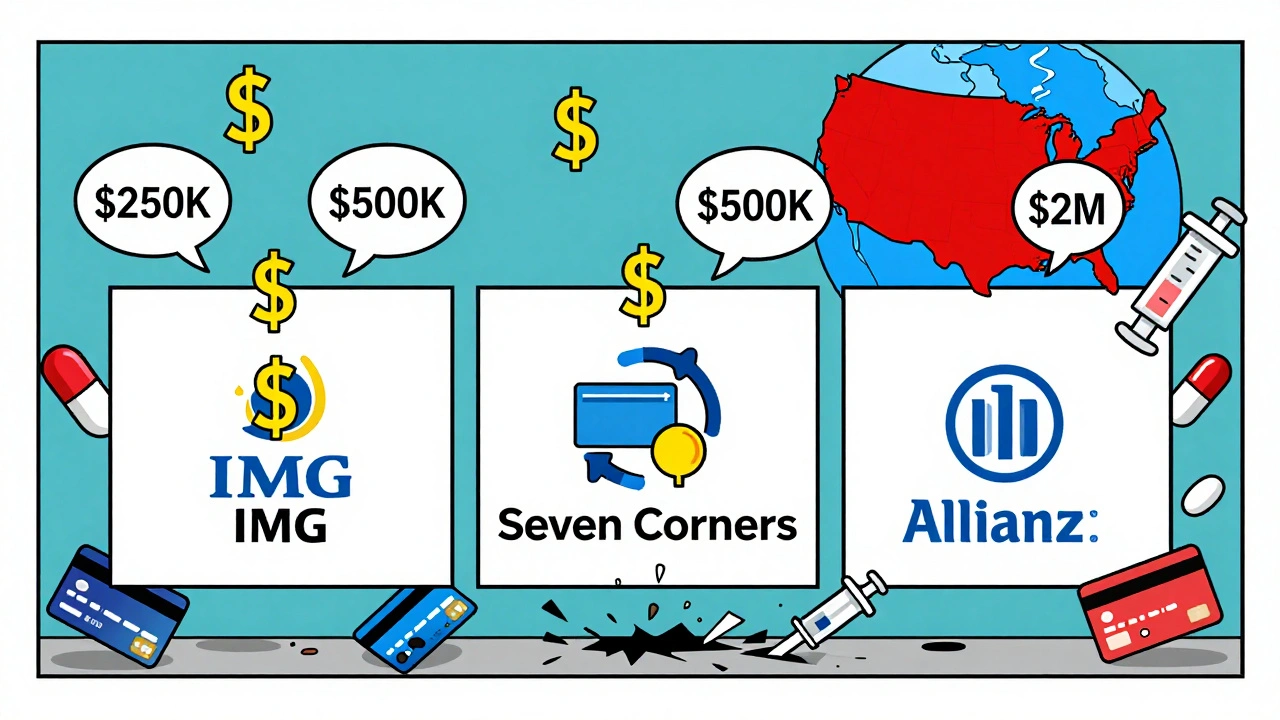

Not all travel insurance companies are equal. Here’s how the top three stack up:

| Provider | Max Medication Coverage | Deductible | Co-insurance | Network Pharmacies | Telemedicine? |

|---|---|---|---|---|---|

| IMG Global | $250,000 | $0-$250 | 80/20 | CVS, Walgreens, Rite Aid | Yes |

| Seven Corners | $500,000 | $0-$250 | 80/20 | CVS, Walgreens, Rite Aid | Yes |

| Allianz Global Assistance | $100,000-$2,000,000 | $50-$500 | 80/20 or 100% | CVS, Walgreens | Yes |

Seven Corners has the highest coverage cap and the best customer service (842/1,000 in J.D. Power’s 2022 study). IMG is the most popular for U.S. trips. Allianz has the widest range of plans - but read the fine print. Some plans cap medication at $50,000.

And if you’re over 65? Medicare won’t help. Medigap plans F, G, C, D, M, and N cover 80% of emergency care abroad - but only if you bought them before January 1, 2020. New enrollees? No international coverage at all.

How to Pick the Right Plan

Don’t just buy the cheapest one. Ask yourself:

- Do I need coverage for the U.S.? If yes, go for at least $100,000 in medical coverage.

- Do I take daily meds? Then bring at least 15% extra - just in case your flight is delayed.

- Do I have a chronic condition? Look for a plan that offers a pre-existing condition waiver. Only 18% of policies offer this - but it’s worth paying extra for.

- Does the plan include telemedicine? It saves hours and avoids ER visits.

- Is the deductible under $250? Lower deductible = less out-of-pocket if something goes wrong.

And always, always read the policy’s “Exclusions” section. That’s where the fine print hides. If it says “no coverage for maintenance medications,” that means no refills - ever.

What to Do Before You Leave

Here’s your checklist:

- Bring all your current prescriptions - with original bottles and doctor’s notes.

- Ask your doctor for a letter listing your conditions and meds - in English.

- Get a 3-month supply, even if your trip is 2 weeks. Delays happen.

- Take a photo of your prescriptions and insurance card. Store it in the cloud.

- Download your insurer’s app. Know how to submit claims before you leave.

- Write down the emergency number for your insurer. Save it in your phone.

One traveler lost his meds in a hotel fire in Germany. He had a letter from his UK doctor, a photo of his prescriptions, and his insurance app. He got a new prescription within 48 hours. No out-of-pocket cost.

Final Reality Check

Travel insurance for medication isn’t glamorous. It’s not about luxury trips or beach vacations. It’s about peace of mind. It’s about not having to choose between buying your insulin or paying for a hotel. It’s about not being stranded because you can’t afford your antibiotics.

The global travel insurance market hit $16.5 billion in 2022. And 68% of claims are for medical expenses. Medication costs make up 15% of those. That’s not a small number. That’s thousands of people who got caught off guard.

You wouldn’t drive without insurance. Why risk your health overseas without it?

Don’t wait until you’re sick to figure it out. Buy the right policy before you leave. Bring your meds. Know the rules. And if something goes wrong - you’ll be ready.

12 Comments

Just got back from a trip to Florida and this hit HARD. I forgot my blood pressure meds and thought my card insurance would cover it. Ended up paying $800 out of pocket because the pharmacy said ‘no foreign prescriptions.’ Don’t be me. Bring extra. Always. And get real travel insurance - not that credit card junk.

Wait - so if you’re diabetic and your insulin gets stolen, you’re SOL unless you’ve got a U.S. doctor’s note? That’s wild. I didn’t realize the system was this rigid. I thought travel insurance was supposed to help in emergencies. Guess ‘emergency’ doesn’t include ‘I’m dying without my meds.’

Life is a prescription. We carry our pills like holy relics. But the world? It doesn’t care if your thyroid is asleep.

Wow. So you’re telling me people actually think their Visa Platinum covers insulin? That’s not ignorance - that’s willful negligence. And if you’re over 65 and think Medicare helps abroad? You’re not just unprepared - you’re a walking liability. This post should be mandatory reading before anyone books a flight.

It's important to note that telemedicine integration is a game-changer. Many travelers overlook this feature, but it reduces both time and financial risk significantly. I've personally used IMG's service in Mexico and received a prescription within 22 minutes. The key is preparation - not panic.

I’ve traveled to 17 countries and never had a problem with meds because I always bring 3 months’ supply. It’s not hard. It’s not expensive. It’s just common sense. If you can’t do that, maybe you shouldn’t be traveling.

The structural inequity here is staggering. The global healthcare architecture treats chronic conditions as disposable when you cross a border. Your body becomes a liability to the system. The fact that you need a U.S.-licensed doctor to refill your antidepressants - while the U.S. has no universal healthcare - reveals a deeper hypocrisy. We commodify health, then punish those who depend on it.

I used to think I was just being ‘responsible’ by bringing extra meds. Then I met a guy in Bali who got denied coverage because his insulin was ‘pre-existing.’ He cried. I didn’t. I just thought: if you can’t manage your own health, why should the world pay for your mistake? 🤷♂️

PSA: Take a pic of your prescriptions + doctor’s note. Save it to iCloud. I lost my bag in Paris. Had the pics. Got refilled same day. No drama. No panic. Just smart. 💪

I’m a nurse and I’ve seen this happen too many times. People show up at ERs with a bottle of pills from Canada and expect to get a refill. They don’t understand that U.S. pharmacies can’t legally dispense foreign prescriptions - even if the drug is identical. And the worst part? The doctors are usually sympathetic but legally powerless. It’s not about being mean - it’s about liability. If you’re on chronic meds, plan like you’re preparing for a moon landing. Bring double. Triple. Have backup documentation. And never, ever assume your credit card’s ‘insurance’ is enough. I’ve had patients pay $2,000 for a five-day supply of metformin because they didn’t read the fine print. It’s preventable. Always.

This reminded me of my aunt in Germany last year. She had a heart issue, needed a new beta-blocker, and couldn’t get it because her U.S. doctor’s note wasn’t stamped properly. Took her three days to get a local doctor to sign off. She ended up paying $600 because the pharmacy wasn’t in-network. She’s fine now - but she’s never traveling without the checklist again. Seriously, folks. Print this out. Stick it in your suitcase.

George, your aunt’s story is exactly why I carry a laminated card with my meds, allergies, and doctor’s contact info. I even got it translated into Spanish and French. Took 20 minutes. Saved me $1,200. You’re right - it’s not glamorous, but it’s survival.