The U.S. Food and Drug Administration (FDA) doesn’t wait for dangerous drugs to reach pharmacy shelves before acting. Instead, it stops them at the border-no inspection needed. Since September 2025, hundreds of shipments of weight-loss drug ingredients like semaglutide and tirzepatide have been automatically seized at U.S. ports. Why? Because they came from manufacturers not on the FDA’s approved list. This isn’t a random crackdown. It’s the FDA Import Alerts system in full force, and it’s changing how the entire global drug supply chain operates.

What Are FDA Import Alerts?

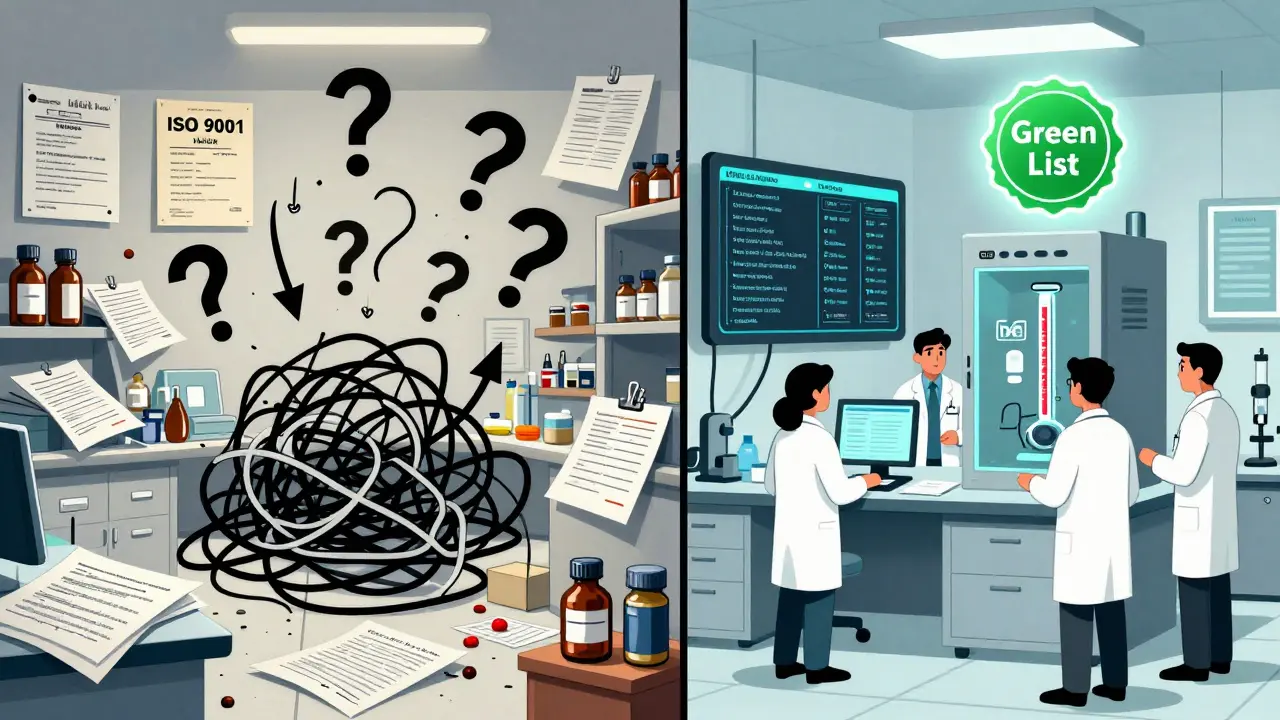

FDA Import Alerts are official notices that tell customs agents to automatically hold (detain) shipments from specific manufacturers or countries without physically inspecting them. This is called Detention Without Physical Examination, or DWPE. Once a manufacturer is flagged, every future shipment from them gets stopped. The system started in 1995 but got a major upgrade in 2025 with the PREDICT program, which uses data to predict which shipments are likely to be unsafe.There are three color-coded lists:

- Green List: Manufacturers that have proven compliance. Their shipments clear customs quickly-99.2% approval rate.

- Yellow List: Manufacturers with past issues but working to fix them. Shipments may be held for review.

- Red List: Manufacturers with repeated violations. Shipments are automatically detained with no exceptions.

As of November 2025, there were 238 active Import Alerts covering everything from antibiotics to insulin. But the most aggressive one-Import Alert 66-80-targets GLP-1 active pharmaceutical ingredients (APIs). This alert was issued after the FDA found widespread contamination, incorrect dosing, and fake documentation in imported weight-loss drug ingredients.

How the System Works: Data, Not Guesswork

The FDA doesn’t just pick manufacturers out of thin air. The PREDICT algorithm evaluates over 150 data points:- History of past inspections and violations

- Refusal rates for previous shipments

- Quality of Certificates of Analysis (CoA)

- Importer compliance records

- Facility inspection outcomes

When a manufacturer fails multiple times, the system flags them. A single shipment might get refused because of a missing document. But if the same company keeps making the same mistakes, the FDA puts them on the Red List. No second chances.

Once flagged, shipments are held at any of the 328 U.S. ports of entry. The importer has to submit a full corrective action plan: third-party audit reports, stability test results, raw material traceability records, and proof the facility meets FDA standards. If they don’t, the drugs are either destroyed or sent back within 90 days.

The Real Cost of Getting It Wrong

It’s not just about lost inventory. The financial penalties are brutal.Under U.S. customs law (19 CFR § 159.14), companies can be charged up to three times the value of the seized goods. In one October 2025 case, a $900,000 shipment of semaglutide API was refused. The company owed $2.7 million in liquidated damages. That’s not a fine-it’s a bankruptcy risk.

And it’s not just the big players. Small API suppliers in India and China are getting hit hardest. Of the 89 manufacturers affected by the GLP-1 Import Alert, 73 (82%) were in India. One manufacturer on Reddit reported losing $1.2 million in 72 hours-not because their drug was contaminated, but because their auditor wasn’t FDA-recognized. Their ISO 9001 certification didn’t matter. Only FDA-approved audits count.

Why India and China Are the Main Targets

India is the world’s largest supplier of generic APIs. But many of its facilities haven’t kept up with FDA’s evolving standards. The FDA found:- 41.7% of refused shipments had incorrectly formatted Certificates of Analysis

- 33.8% lacked full master production records

- 28.5% couldn’t trace raw materials back to their source

China has fewer facilities on the list, but its manufacturing practices are under heavier scrutiny. In 2025, China’s National Medical Products Administration (NMPA) announced it would require all API exporters to meet FDA-equivalent standards starting January 1, 2026. That’s a direct response to U.S. pressure.

European manufacturers are also affected, but less so. Their quality systems are more aligned with FDA expectations. The difference? Many European companies already use FDA-recognized auditors and real-time batch tracking systems. They didn’t wait for the crackdown to get ready.

Green List: The Only Way Forward

The only way to avoid automatic detention is to get on the Green List. But it’s not easy.Getting approved takes 137±28 hours of work and costs between $45,000 and $68,000. You need:

- A third-party audit by an FDA-recognized body

- Stability testing under three conditions: 2-8°C, 25°C/60% RH, and 40°C/75% RH

- Supply chain mapping to Tier 3 suppliers (the suppliers of your suppliers’ suppliers)

- Proof of consistent compliance over three consecutive shipments

Companies that submit video evidence of their corrective actions have an 87.4% approval rate. Those who only submit paperwork? Just 42.1%. The FDA wants to see proof, not promises.

Some companies are investing $200,000 to $500,000 in blockchain traceability systems. Pfizer, for example, used the MediLedger network to track 17 API suppliers. Their Green List acceptance rate jumped to 99.8%.

What Happens When Drugs Are Refused?

Refused shipments don’t just disappear. They’re held at customs while the importer decides what to do:- Export the shipment back to the country of origin

- Destroy the product under FDA supervision

- Apply for reclassification (rare, only if the issue was paperwork)

But some companies are cutting corners. ProPublica found that some intermediaries are paying brokers to falsify export documents to avoid destruction fees. In one case, the FDA issued a Warning Letter to a Singapore-based intermediary for submitting fake paperwork.

And here’s the irony: 22.1% of refused GLP-1 shipments actually met pharmacopeial quality standards. They were rejected because of missing paperwork, not dangerous drugs. That’s a system failure-not a safety failure.

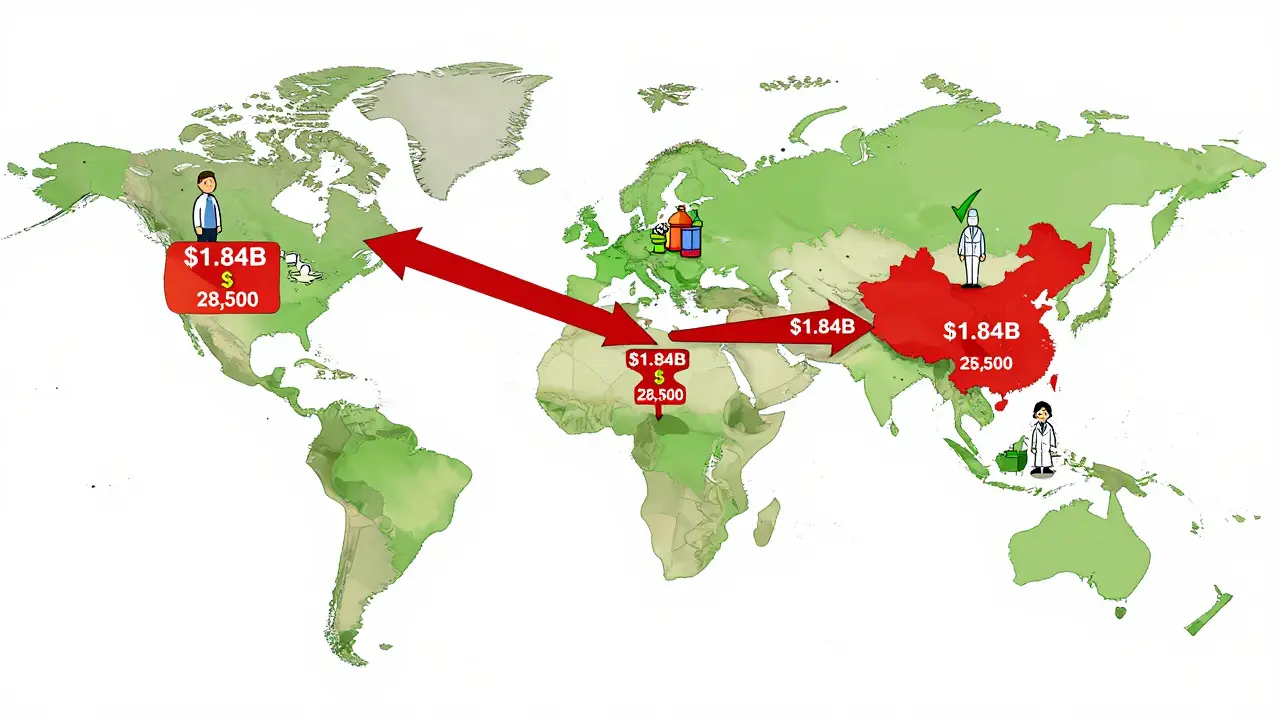

The Ripple Effect: Prices, Jobs, and Supply Chains

The GLP-1 import ban has sent shockwaves through the market:- API imports from non-Green List manufacturers dropped 92.4% from September to October 2025

- $1.84 billion in shipments were refused through October 31, 2025

- U.S. pharmacy benefit managers reported a 14.3% price increase for compounded GLP-1 drugs

- 28,500 jobs in India are at risk across 47 facilities

Big companies like Novo Nordisk and Eli Lilly are benefiting. Their partners on the Green List gained 18.7% market share in just six weeks. Generic drugmaker Viatris reported a $417 million revenue hit in Q3 2025.

Even global contract manufacturers are consolidating. Catalent bought Novasep’s peptide business for $980 million in October 2025-directly because of the new import rules.

What’s Next? The FDA Isn’t Stopping

The GLP-1 alert is just the beginning. FDA Commissioner Dr. Robert Califf announced in November 2025 that the same framework will be extended to all high-risk biologics starting Q1 2026-starting with monoclonal antibodies.By 2027, McKinsey predicts 65-75% of global API manufacturers will need to spend $500,000 to $2 million on compliance upgrades to keep selling to the U.S. market. That includes:

- Upgrading lab equipment for real-time testing

- Implementing blockchain traceability

- Hiring full-time FDA compliance officers

- Training staff on FDA documentation standards

Even the European Union is taking notice. The EMA announced in November 2025 that it will adopt similar API screening protocols by Q2 2026. This isn’t just a U.S. rule anymore-it’s becoming the global standard.

What Manufacturers Must Do Now

If you’re a manufacturer supplying APIs to the U.S., here’s your checklist:- Check if your facility is on the FDA’s Import Alert list (search FDA’s Enforcement Page)

- If you’re on the Red or Yellow List, start a corrective action plan immediately

- Get an FDA-recognized third-party audit-don’t use ISO 9001 alone

- Map your entire supply chain to Tier 3

- Invest in batch-level traceability (even if it’s just a simple digital log)

- Submit your Green List application before your next shipment

Waiting until your shipment gets seized is a gamble you can’t afford to lose.

What happens if my drug shipment is detained by the FDA?

If your shipment is detained, you have 90 days to either export it back to its origin or destroy it under FDA supervision. You can also submit a corrective action plan to request release, but this requires detailed documentation including third-party audit reports, stability test results, and proof of facility compliance. Without this, the shipment will be destroyed, and you may face penalties up to three times the value of the goods.

How can I get my manufacturer on the FDA Green List?

To get on the Green List, you must pass a rigorous application process. This includes hiring an FDA-recognized third-party auditor, conducting stability testing under three different temperature and humidity conditions, mapping your supply chain to Tier 3 suppliers, and submitting three consecutive compliant shipments. The process takes 3-6 months and costs between $45,000 and $68,000. Submitting video evidence of your corrective actions increases your approval odds by more than double.

Why are so many Indian manufacturers affected by the GLP-1 import alert?

India produces about 80% of the world’s generic APIs, but many facilities haven’t upgraded to meet FDA’s strict documentation and traceability standards. The FDA found that 82% of the manufacturers hit by the GLP-1 import alert are based in India, primarily due to missing Certificates of Analysis, unverified raw material sourcing, and lack of FDA-recognized audits. It’s not that their products are unsafe-it’s that their paperwork doesn’t meet U.S. requirements.

Is the FDA targeting only weight-loss drugs?

No. While the GLP-1 import alert (66-80) is the most publicized, the FDA has 238 active Import Alerts covering antibiotics, insulin, cancer drugs, and other high-risk products. The GLP-1 alert is just the first to use the new Green List system. Starting in Q1 2026, the same rules will apply to monoclonal antibodies and other biologics. The goal is to expand this system to all high-risk drug categories by 2027.

Can I still import drugs from China or India?

Yes-but only if the manufacturer is on the FDA’s Green List. If they’re not, your shipment will be automatically detained. The FDA doesn’t ban countries; it bans specific facilities. Many Chinese and Indian manufacturers are now investing millions to get certified. If you’re sourcing from these regions, verify the manufacturer’s status on the FDA’s Import Alert page before placing any order.

What’s the difference between FDA Import Alerts and EMA’s system?

The European Medicines Agency (EMA) uses random sampling-inspecting 10-15% of high-risk shipments. The FDA uses predictive enforcement: if a manufacturer has a history of violations, every shipment is automatically detained without inspection. The FDA system is faster and more aggressive, reducing inspection time by 78%, but it has a higher false positive rate (17% vs. 4.7% under EMA). The FDA’s Green/Yellow/Red system also gives manufacturers a clear path to compliance, which EMA doesn’t offer.

12 Comments