When you hear the word generic, you probably think of a cheap, identical copy of a brand-name pill. But when it comes to biologic drugs - complex medicines made from living cells to treat cancer, rheumatoid arthritis, diabetes, and other serious conditions - nothing is that simple. That’s where biosimilars come in. They’re not exact copies. They’re highly similar versions, and getting them approved by the FDA is a whole different ballgame than approving a generic tablet.

Why Biosimilars Aren’t Like Generics

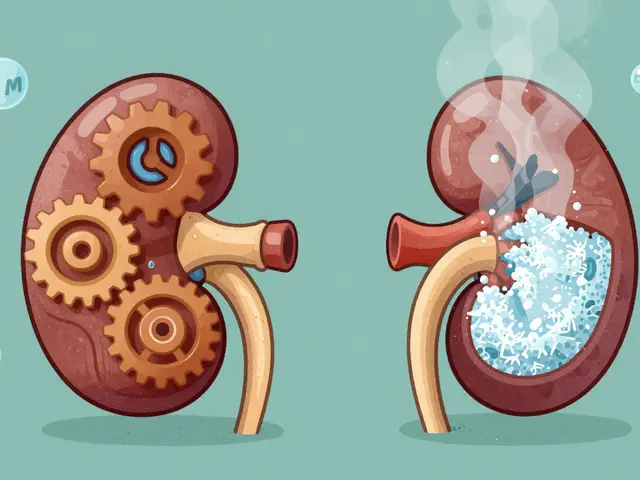

Generic drugs are chemically identical to their brand-name counterparts. If you break down a generic aspirin, you’ll find the same molecule as the brand version. Biosimilars? Not even close. Biologics are made from living organisms - cells, proteins, antibodies - and even tiny changes in how they’re grown or processed can affect how they work in the body. Two biosimilars made by different companies might look almost the same under a microscope, but their behavior in your bloodstream can vary slightly.This complexity is why the FDA doesn’t use the same shortcut it uses for generics. You can’t just prove a biosimilar has the same active ingredient. You have to prove it behaves the same way in the body - and that’s expensive. Until recently, developing a biosimilar cost between $100 million and $300 million and took up to 10 years. Many companies walked away because the return didn’t justify the risk.

The Big Shift in 2025: FDA’s New Guidance

On October 29, 2025, the FDA dropped a bombshell: a new draft guidance that changes how biosimilars are approved. For the first time since the Biologics Price Competition and Innovation Act (BPCIA) passed in 2010, the agency no longer routinely requires full clinical efficacy studies comparing the biosimilar to the original biologic.Instead, the FDA now says: if you can prove analytical similarity - meaning your molecule matches the original in structure, purity, and function - and you’ve shown matching pharmacokinetics (how the body absorbs and processes it) and low immunogenicity (low risk of triggering immune reactions), that’s often enough. No need to run a three-year trial to prove it works just as well in patients with rheumatoid arthritis or breast cancer.

This isn’t a loophole. It’s science catching up. Modern tools like mass spectrometry and advanced chromatography can now detect differences smaller than one molecule in a million. The FDA says these tools are so precise, they can predict clinical outcomes better than traditional trials - especially for well-understood proteins like adalimumab or trastuzumab.

What’s Required Now? The Three-Part Test

The FDA’s updated approach isn’t a free pass. It’s a smarter filter. For a biosimilar to skip the full efficacy trial, three conditions must be met:- The reference product and biosimilar must come from clonal cell lines and be highly purified - meaning the manufacturing process is tightly controlled.

- The link between the molecule’s structure and its clinical effect must be well understood. For example, we know exactly how a monoclonal antibody binds to a cancer cell target.

- A human pharmacokinetic (PK) study must be feasible and relevant. This means you can track how fast the drug enters and leaves the bloodstream in healthy volunteers - and that data matches the original.

If those boxes are checked, the FDA will accept analytical and PK data as proof of biosimilarity. This cuts development time by 2-3 years and slashes costs to $50-$150 million per product. For companies that couldn’t afford the old process, this is a lifeline.

Interchangeability: The Controversial Change

Here’s where things get messy. Interchangeability means a pharmacist can swap your biologic for a biosimilar without asking your doctor. In the U.S., that’s been a high bar. You needed “switching studies” - proving that going back and forth between the original and biosimilar doesn’t cause safety issues.In October 2025, FDA Commissioner Marty Makary said something radical: “Every biosimilar should have the designation of interchangeable.” He called interchangeability a “legislative term, not a scientific term.” That sparked outrage from some doctors and industry groups. Critics argue removing the extra layer of proof could erode trust. If a patient has a bad reaction after switching, who’s to blame - the drug, the system, or the lack of data?

Still, the FDA approved two denosumab biosimilars as interchangeable in October 2025 - the first time multiple interchangeable biosimilars were approved for the same reference product. That signals the agency is moving forward, even if the legal framework hasn’t caught up. Right now, 34 states still require prescriber approval before substitution, creating confusion for pharmacists and patients alike.

Who’s Winning? Who’s Struggling?

Big players like Sandoz, Pfizer, and Amgen have dominated the U.S. biosimilar market with 17, 12, and 10 approved products respectively. They have the labs, the regulatory teams, and the cash to handle the $100 million+ analytical work.Smaller companies? Not so much. Only 12 of the 76 approved biosimilars came from firms with fewer than 100 employees. The barrier isn’t just money - it’s expertise. Setting up a quality control system that meets FDA standards takes 12-18 months. And even then, 42% of biosimilar applications get rejected outright with a “complete response letter” asking for more data.

That’s why the FDA’s new guidance matters. It levels the playing field for companies that can do analytical work but can’t run massive clinical trials. Emerging players like Viatris and Biocon are already moving faster. And with 157 potential biosimilar opportunities still untapped, the market is ripe for disruption.

Real-World Impact: Costs, Savings, and Patient Experiences

The goal isn’t just to get more biosimilars approved - it’s to get them into patients’ hands. Biologics like Humira or Herceptin cost $50,000-$100,000 per patient per year. Biosimilars can cut that by 15-35%. At Mayo Clinic, switching to biosimilars for cancer treatments saved $18 million in one year - a 37% drop in biologic spending.Patients aren’t blind to this. A September 2025 Arthritis Foundation survey of 1,247 users found 78% were satisfied with their biosimilar’s effectiveness. But 41% started out worried about safety. After talking to their doctors, 68% of those fears disappeared. On Reddit, 63% of users reported no difference in symptoms after switching from a biologic to a biosimilar for rheumatoid arthritis. A few noticed more injection site reactions - but nothing serious.

Still, awareness is low. Only 32% of U.S. patients know what a biosimilar is, according to the National Biosimilars Survey. That’s a problem. If patients don’t understand the difference, they may refuse a switch - even if it saves money and works just as well.

How the U.S. Compares to Europe

Europe has been using biosimilars since 2006. The European Medicines Agency (EMA) has approved over 100. Their process is simpler: one PK/PD study, no mandatory interchangeability hurdle. As a result, biosimilars make up 67% of the market for biologics in Europe - compared to just 23% in the U.S.The FDA’s 2025 guidance closes that gap. By dropping the clinical efficacy requirement and loosening interchangeability rules, the U.S. is finally aligning with global standards. Analysts predict biosimilar approvals could jump from 8-10 per year to 15-20. Market value could hit $62 billion by 2029.

What’s Still Holding Biosimilars Back?

Even with the new rules, roadblocks remain. Patent litigation delays 68% of biosimilar launches, according to the FTC. Companies use “patent thickets” - layers of overlapping patents - to block competition for years. The FDA can approve a biosimilar, but if a lawsuit is filed, the launch gets stuck in court.Also, not all biologics are created equal. The new guidance works best for monoclonal antibodies with clear structure-function relationships. It’s less reliable for complex molecules like antibody-drug conjugates, where the drug is chemically attached to the antibody. For those, clinical data may still be needed.

And while the FDA says “all biosimilars are interchangeable,” the law still requires a separate designation. That legal mismatch creates uncertainty for pharmacists, insurers, and prescribers. Until Congress updates the law, the system will stay fractured.

What Comes Next?

The FDA’s draft guidance is open for public comment until January 27, 2026. Final rules are expected by June 2026. The agency is also funded through BsUFA III - a user fee program that runs through 2027 - ensuring they have the resources to review more applications faster.For patients, the future looks brighter. More biosimilars mean lower prices. More competition means innovation. More access means better outcomes for people with chronic diseases who can’t afford $100,000-a-year treatments.

But the real win won’t come from better science alone. It’ll come when patients understand biosimilars, pharmacists feel confident substituting them, and lawmakers fix the legal mess around interchangeability. The FDA has done its part. Now it’s up to the rest of the system to catch up.

8 Comments

The FDA’s new guidance is a masterclass in regulatory pragmatism. Analytical similarity isn’t just good enough-it’s superior when you’ve got mass spectrometry resolving differences at the single-molecule level. The old clinical trial treadmill was a relic of 20th-century pharmacology. We’re not testing aspirin anymore; we’re mapping dynamic protein folding in vivo. If your molecule matches down to the glycosylation pattern, why waste 3 years and $200M proving it doesn’t cause a rash in 200 patients? That’s not science-it’s bureaucratic theater.

And let’s be clear: interchangeability isn’t a scientific concept. It’s a legal fiction created by insurance companies afraid of liability. The data doesn’t care if you switch back and forth. The patient’s immune system does. And if it reacts, it’s not because the biosimilar is different-it’s because *someone* didn’t monitor the transition properly. Blame the system, not the science.

OH MY GOD. I just read this and I’m shaking. This isn’t progress-it’s a betrayal. These aren’t pills. These are LIVING MOLECULES. You think a pharmacist can just swap out Humira for some generic-looking vial and not have someone’s body go into full rebellion? I know a woman who got a biosimilar for RA and her joints started swelling like she’d been poisoned. She didn’t even know she’d been switched! And now the FDA says ‘all biosimilars are interchangeable’? That’s not confidence-that’s negligence wrapped in a lab coat.

They’re rushing this because Big Pharma wants to cut costs, not because patients are safer. We’re turning healthcare into a Walmart aisle. ‘Pick your biologic, it’s on sale this week.’

Can I just say how wild it is that we’re finally catching up to Europe? They’ve been doing this since 2006 and somehow didn’t have a single mass patient meltdown. Meanwhile, we’re acting like biosimilars are alien tech. I love that the FDA is trusting the data over the drama.

Also, the cost savings? Mind-blowing. My cousin with Crohn’s was paying $8K/month for biologics. Switched to a biosimilar last year-same results, $3K/month. He cried. Not from sadness-from relief. We need to stop treating these like magic potions and start treating them like the sophisticated, rigorously tested medicines they are.

Also, 78% patient satisfaction? That’s not a fluke. That’s proof we’ve been over-scaring people for no reason. Let’s give patients credit. They’re smarter than we think.

I’m so glad someone finally said this out loud. The whole interchangeability debate feels like a giant game of telephone. The FDA says one thing, the lawyers twist it, the pharmacists panic, and patients get stuck in the middle.

But honestly? Most of us don’t even know what a biosimilar is. I had to Google it after my doctor mentioned it. Maybe the real issue isn’t the science-it’s the communication. We need plain-language pamphlets in waiting rooms, not jargon-filled FDA documents.

Also, huge props to Viatris and Biocon. They’re the underdogs here, and they’re doing the heavy lifting. Let’s not forget them while we’re busy arguing about patents.

Wait, so if I’m on Humira and my pharmacist swaps me for a biosimilar without telling me, and then I get a rash, who’s liable? The pharmacist? The doctor? The FDA? The company that made the biosimilar? Or am I just supposed to be grateful I’m not paying $100K a year?

And what about the patients who *do* have reactions? Are they just collateral damage in the name of ‘efficiency’? You know what’s efficient? Not switching people who are stable. Why fix what ain’t broke?

Also, why is no one talking about how the FDA’s new rules will affect biologics for kids? Or pregnant women? You think they tested these biosimilars on *those* populations? No. They didn’t. And now we’re just gonna roll the dice? That’s not science. That’s gambling with lives.

THIS IS A COVER-UP. You think this is about science? NO. It’s about the pharmaceutical cartel. They’ve been bribing FDA officials since 2018. The ‘analytical similarity’ loophole? It was designed by lobbyists who used to work at Pfizer. They don’t want cheaper drugs-they want to lock in market dominance under a new name.

And don’t get me started on the ‘interchangeable’ nonsense. They’re setting us up for mass poisoning. You think the CDC won’t cover it up if 50,000 people get autoimmune flares next year? They’ll say ‘it was stress’ or ‘genetics.’

Check the patent filings. Every single biosimilar approved since October 2025 has a parent company that also owns the original biologic. Coincidence? Or is this just corporate rebranding with a lab coat?

Wake up, people. This isn’t progress. It’s a heist.

So let me get this straight: the FDA is finally acting like a rational agency, and suddenly everyone’s losing their minds?

Bro. We’ve been doing this in Europe for 20 years. People are fine. Biosimilars work. Patients save money. Pharmacists don’t quit their jobs. And yet here we are, screaming like the sky is falling because someone might get a slightly itchy injection site.

Also, ‘interchangeable’ isn’t a scientific term? No kidding. It’s a legal term. So fix the law, not the science.

And yes, I’m sarcastic. But I’m also the person who switched to a biosimilar for my psoriasis and now have $12,000 extra in my bank account. So I’ll take ‘scientifically proven’ over ‘fear-based hysteria’ any day.

Let’s deconstruct this with precision. The FDA’s 2025 guidance is not a revolution-it’s an evolution of regulatory capture. The agency has long relied on industry-submitted analytical data because it lacks the infrastructure to independently validate complex biologics. The new guidance doesn’t reduce burden-it externalizes risk. The patient becomes the experimental subject in an uncontrolled, real-world trial. The clinical efficacy studies were never about proving ‘effectiveness’-they were about establishing a legal and ethical firewall between manufacturer liability and patient harm.

Furthermore, the claim that ‘modern analytical tools can predict clinical outcomes better than trials’ is a fallacy of reification. Mass spectrometry measures structure, not function. Function is emergent, context-dependent, and organism-specific. A molecule may be structurally identical, but its interaction with a patient’s unique microbiome, epigenetic profile, and immune history cannot be modeled with chromatography.

The EMA’s success in Europe is not evidence of superior science-it’s evidence of cultural tolerance for systemic risk. The U.S. healthcare system is not Europe. We have fragmented insurance, disparate access, and a population with higher rates of comorbidities. What works in a monocentric, publicly funded system does not translate to a hyper-commercialized, litigation-prone one.

And the notion that patients are ‘glad’ to save money ignores the psychological impact of substitution. Trust in medicine is not transactional. When a patient is switched without consent, the therapeutic alliance fractures-even if the molecule is identical. The placebo effect is not a placebo. It is pharmacology of the mind. And you cannot patent that.

The real issue isn’t cost. It’s autonomy. The FDA is not a patient advocate. It is a gatekeeper of corporate interests masked as scientific progress. The numbers look good on paper. But medicine is not a spreadsheet. It is a covenant between healer and healed. And when that covenant is broken by bureaucratic expediency, no amount of analytical data can restore it.