The Hatch-Waxman Act didn’t just change how drugs get approved in the U.S.-it rewrote the rules of the entire pharmaceutical market. Before 1984, if you wanted to make a generic version of a brand-name drug, you had to start from scratch: run full clinical trials, prove safety and effectiveness all over again, and wait years just to get to the starting line. Meanwhile, the company that invented the drug held a monopoly, often for decades, thanks to patent protections that didn’t account for the time the FDA took to review their application. That system was broken. The Hatch-Waxman Act fixed it-by design.

What the Hatch-Waxman Act Actually Did

Passed in 1984, the full name is the Drug Price Competition and Patent Term Restoration Act. It’s named after its two sponsors: Rep. Henry Waxman and Sen. Orrin Hatch. But this wasn’t just another law. It was a hard-won deal between two powerful sides: big pharma companies that wanted more patent time, and generic drug makers that wanted faster access to the market. The Act solved two problems at once. First, it gave innovator companies a way to get back some of the patent time they lost while waiting for FDA approval. On average, they got about 2.6 extra years of exclusivity. Second, it created a shortcut for generic drug makers to get approved without repeating expensive clinical trials. That shortcut? The Abbreviated New Drug Application, or ANDA. An ANDA doesn’t need to prove a drug works. It just needs to prove it’s the same as the brand-name version-same active ingredient, same dose, same way it’s absorbed by the body. That’s called bioequivalence. And because of this, generic drug development costs dropped by roughly 75% compared to a brand-new drug application.The Safe Harbor: A Game-Changer for Generic Companies

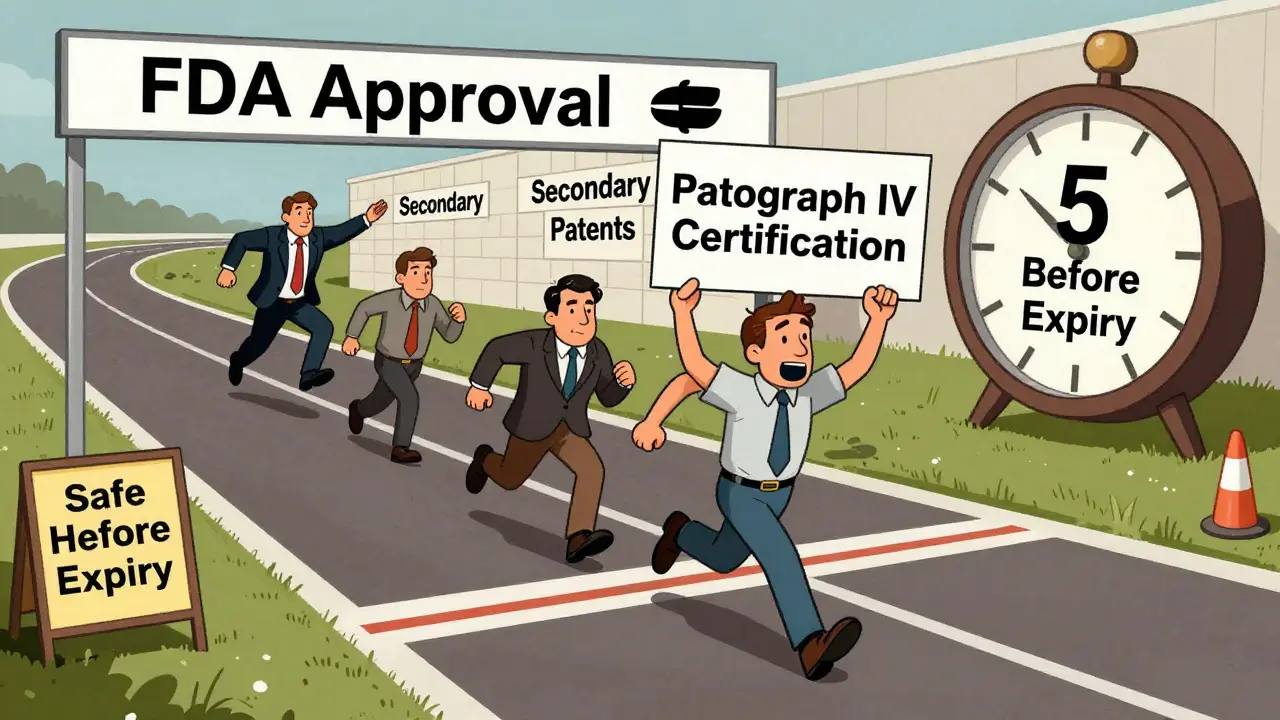

Before Hatch-Waxman, even testing a patented drug during its patent term was illegal. The 1984 Supreme Court case Roche v. Bolar ruled that it was patent infringement. That meant generic companies couldn’t start preparing until the patent expired-losing years of potential market time. Hatch-Waxman changed that with a simple but powerful clause: 35 U.S.C. §271(e)(1). It created a legal “safe harbor.” Generic manufacturers can now make, test, and study patented drugs while the patent is still active-as long as the only goal is to gather data for FDA approval. This meant companies could begin development up to five years before a patent expired. That’s not a minor tweak. It’s the reason generic drugs hit the market so fast after patents end.How Generic Drugs Got Their First-Mover Advantage

One of the most controversial-and powerful-parts of the Act is the 180-day exclusivity period for the first generic company to file an ANDA with a Paragraph IV certification. That’s a fancy way of saying: if you’re the first to say a patent is invalid or won’t be infringed, you get six months of exclusive rights to sell your version before anyone else can. This created a rush. In the late 1990s, generic companies would literally camp outside FDA offices to be first to file. The FDA eventually changed the rules in 2003 to allow shared exclusivity if multiple companies filed on the same day. But the incentive stayed: being first still meant big profits. That exclusivity window is why some generic companies are willing to spend $15 to $30 million on patent lawsuits. The payoff? Millions in sales during those 180 days. For blockbuster drugs, that’s worth it.

Why Generic Drugs Are So Cheap-And So Common

The results speak for themselves. In 1984, fewer than 10 generic drugs were approved each year. In 2019, the FDA approved 771. Today, generics make up 90% of all prescriptions filled in the U.S.-but only about 18% of total drug spending. That’s how powerful competition is. Once a generic enters the market, prices drop fast. Within six months, they’re typically at 15% of the brand-name price. Since 1991, the Act has saved the U.S. healthcare system over $1.18 trillion, according to the Congressional Budget Office. And it’s not just about savings. The Act helped fuel innovation too. With the promise of patent term restoration, drug companies had more incentive to invest in new drugs. Between 1984 and 2018, the U.S. approved far more new molecular entities than it would have without Hatch-Waxman. The trade-off worked-for a while.The Dark Side: Patent Games and Market Manipulation

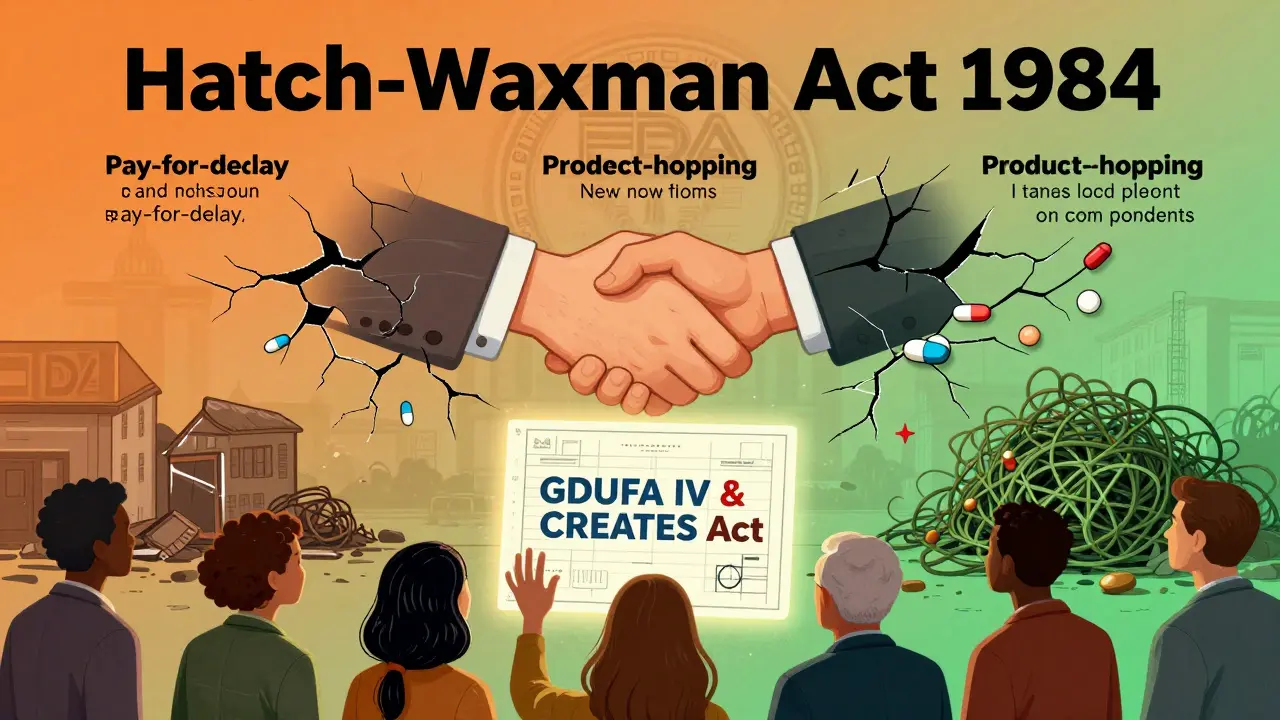

But the system wasn’t perfect. As time passed, both sides found ways to game it. Brand-name companies started filing dozens of patents on minor changes-like a new coating, a different pill shape, or a slightly altered dosage schedule. These are called “secondary patents.” In 1984, the average drug had 3.5 patents listed in the FDA’s Orange Book. By 2016, that number jumped to 2.7 per drug. Wait-that’s not right. Actually, it jumped to 14 patents per drug. That’s not a typo. These patent thickets create legal roadblocks. Generic companies now face 4.3 patent challenges per drug on average-up from just 1.2 in 1984. Some lawsuits stretch for years. One generic manufacturer on Reddit said they’ve seen brands file over 50 patents on a single drug, turning patent litigation into a 7- to 10-year marathon. Then there’s “product hopping.” That’s when a brand company makes a tiny change to a drug-say, switching from a pill to a tablet-and then markets the new version as “improved.” They then let the old version’s patent expire while keeping the new one protected. Patients get forced into the pricier version. And the worst? “Pay-for-delay.” Sometimes, brand companies pay generic makers to hold off on launching their version. Between 2005 and 2012, 10% of all generic challenges ended this way. The FTC called it anti-competitive. Congress tried to ban it with the 2023 Preserve Access to Affordable Generics Act-but it’s still a problem.How the FDA Is Trying to Fix the System

The FDA knows the system is clogged. That’s why they launched the Generic Drug User Fee Amendments (GDUFA) in 2012. Generic companies now pay fees to fund faster reviews. Before GDUFA, ANDA reviews took 36 months. Now, it’s down to 10 months on average. But 43% of initial ANDA submissions still get rejected for major flaws. The paperwork? Often 30,000 to 50,000 pages. It’s a nightmare to prepare. The FDA’s QbR Pilot Program has helped cut approval times by 35% for companies that use it. In 2022, the FDA also released draft guidance to crack down on improper patent listings in the Orange Book. They want to stop companies from listing patents that don’t actually cover the drug’s use. That’s a direct response to the patent thicket problem. And by 2025, the FDA aims to cut ANDA review times to just 8 months under GDUFA IV. If they hit that target, generic drugs could enter the market 1.4 years faster on average. That could save another $45 billion a year by 2030.

Who Benefits-and Who Gets Left Behind?

The winners? Patients. Pharmacies. Insurers. Taxpayers. The 90% of Americans who take generic drugs every day. The losers? Small generic companies that can’t afford $30 million lawsuits. Patients stuck on expensive brand-name drugs because their insurer won’t cover the generic. Communities where the only pharmacy left is one that stocks only high-cost brand drugs because generics haven’t broken through. The top 10 generic manufacturers now control 62% of the market-up from 38% in 2000. Consolidation means fewer players, less competition, and more pressure on the system. Meanwhile, the average drug now gets 13.2 years of effective market exclusivity-nearly three years longer than in 1984. That’s not because of the original law. It’s because of the loopholes.Is the Hatch-Waxman Act Still Working?

The answer isn’t yes or no. It’s complicated. The core idea-balance-is still sound. Without Hatch-Waxman, we wouldn’t have 90% generic use. We wouldn’t have saved trillions. We wouldn’t have affordable insulin, statins, or antibiotics. But the system is strained. Patent thickets, pay-for-delay, product hopping-they’re not bugs. They’re features of a system that was never meant to handle this level of legal complexity. The 2022 CREATES Act helped by forcing brand companies to provide samples for testing. The 2023 bill to ban pay-for-delay is a step forward. But real reform needs more: clearer rules on patent listings, limits on secondary patents, and faster court resolutions for generic challenges. The Hatch-Waxman Act didn’t just change drug policy. It shaped the modern pharmaceutical industry. It’s still the foundation. But like any foundation, it needs repairs.What is the ANDA pathway under the Hatch-Waxman Act?

The Abbreviated New Drug Application (ANDA) is the streamlined process created by the Hatch-Waxman Act that allows generic drug manufacturers to get FDA approval without repeating expensive clinical trials. Instead, they must prove their product is bioequivalent to the brand-name drug-meaning it delivers the same amount of active ingredient into the bloodstream at the same rate. This cuts development costs by about 75% and speeds up approval.

How does the 180-day exclusivity period work for generic drugs?

The first generic company to file an ANDA with a Paragraph IV certification (claiming a patent is invalid or won’t be infringed) gets 180 days of exclusive marketing rights. During that time, no other generic can enter the market. This incentive drives competition, but it’s also been exploited-some companies delay launch to avoid litigation, and others form alliances to share exclusivity. The FDA now allows shared exclusivity if multiple companies file on the same day.

What is a Paragraph IV certification?

A Paragraph IV certification is a legal statement made by a generic drug applicant that challenges a patent listed in the FDA’s Orange Book. The applicant claims the patent is invalid or that their product won’t infringe it. This triggers a 45-day window for the brand-name company to sue. If they do, FDA approval is automatically delayed for 30 months-or until the court rules.

Why do brand-name companies file so many patents?

Brand companies file multiple patents-sometimes 14 or more per drug-to create a “patent thicket.” These include patents on dosage forms, methods of use, manufacturing processes, or minor chemical changes. Even if most patents are weak, they delay generic entry by forcing lawsuits. Each lawsuit can add months or years to the timeline, keeping prices high longer.

What are pay-for-delay settlements?

Pay-for-delay, or reverse payment settlements, happen when a brand-name drug company pays a generic manufacturer to delay launching its cheaper version. Instead of competing, the two companies agree to split the market. These deals are anti-competitive and were common between 2005 and 2012. The 2023 Preserve Access to Affordable Generics and Biosimilars Act aims to ban them, but they still occur.

How has the Hatch-Waxman Act affected drug prices?

Generic drugs approved under Hatch-Waxman typically drop to 15% of the brand-name price within six months of entry. Since 1991, the Act has saved the U.S. healthcare system over $1.18 trillion. However, patent abuse tactics like product hopping and pay-for-delay have increased drug spending by $149 billion annually since 2010, offsetting some of those savings.

15 Comments

The Hatch-Waxman Act was a quiet revolution. I never thought about how much of my medicine’s cost came from legal games, not science. It’s wild that a 1984 law still holds up today, even as the industry changed so much. We need to fix the loopholes, but don’t throw the baby out with the bathwater.

Oh please. This whole thing is just corporate theater. Big Pharma invented ‘patent thickets’ to keep prices high, and now we’re acting like it’s some noble compromise. The 180-day exclusivity? That’s just a monopoly with a different name. And don’t even get me started on pay-for-delay - it’s bribery with a law degree.

bro the ANDA thing is genius 😎 but why do they still make 50k-page applications?? 🤡 also why is the FDA so slow if they get user fees??

i never realized how much i rely on generics until i had to pay full price once... it was insane. this law saved me so many times. i dont even know how to thank the people who made it happen

Let’s not forget: this law didn’t just lower prices - it made healthcare accessible. In countries without similar frameworks, people choose between medicine and rent. Hatch-Waxman gave us a model - flawed, yes - but one that works. We must improve it, not abandon it.

patent thicket?? more like patent jungle 🌿💀 some companies file patents on the color of the pill. i swear to god if i had to pay $200 for a blue pill when the white one does the same thing... i'd riot.

...I just read this whole thing... and I'm crying... not because it's sad... but because it's so... so... beautifully complicated? I didn't know any of this. I just took my pills. Now I feel like I owe someone an apology. Or a thank you. Or both.

This is a textbook case of regulatory capture. The FDA, the Congress, the courts - all are complicit. You call it a ‘balance’? I call it a cartel. The pharmaceutical industry owns this system, and you’re all just narrating the script they wrote. Wake up.

real talk the 180 day thing is wild but its the only reason generics even bother trying. if no one got that window no one would risk the lawsuit cost. its messed up but its the only thing keeping it alive

Generic drugs saved my dad’s life. No debate.

my uncle works at a generic lab in hyderabad. he says they get 30k page applications and still get rejected because of a typo in the solvent name. it's not about the science anymore. it's about paperwork warfare

the pay for delay thing is so gross i cant even... i mean imagine getting paid to NOT help people? like... how do you sleep at night??

While the Hatch-Waxman Act was groundbreaking, its current implementation reveals structural weaknesses. The legal and bureaucratic burdens on generic manufacturers have increased disproportionately since 1984, undermining the original intent of promoting competition.

the fact that we need a 2023 law to ban pay-for-delay says everything. if you're paying someone to not compete, you're not a business - you're a criminal. and the system lets you get away with it.

you people are so naive. this isn't about 'fixing' the system - it's about who controls the money. the FDA, the pharma giants, the lawyers - they're all in the same club. the 90% generic stat? cute. but the 14 patents per drug? that's the real story. the system is rigged. and you're just cheering for the cheat code.