9 Feb |

11:07 AM

When you pick up a prescription, you might not think about who made the pill or how much it cost to produce. But behind every bottle of medication-whether it’s a brand-name drug or a generic-is a complex system of labor, regulation, and economics. And the labor costs for these two types of drugs? They’re not even close.

Why Generic Drugs Cost So Much Less

You’ve probably noticed that generic drugs cost a fraction of their brand-name counterparts. A brand-name statin might run you $200 a month. The generic version? $10. That’s not because the generic is made of cheaper ingredients. It’s because the labor structure behind it is completely different. Generic drug manufacturers don’t have to spend years and billions developing a new molecule. They don’t need to run clinical trials. They don’t need to market the drug. All they need to do is prove their version is bioequivalent to the original. That changes everything about how they spend money-including on people. For brand-name drugs, labor makes up 30% to 40% of total production costs in the early years. That’s because every step-from designing the formulation to managing regulatory filings to training staff on complex processes-is done from scratch. Each batch is treated like a new project. Engineers, chemists, quality control specialists, and regulatory experts all work on a single product, often with low volume and high scrutiny. Generic manufacturers? They’re doing the same job, but at scale. Once a drug’s patent expires, dozens of companies can start making it. They don’t need R&D teams. They don’t need marketing departments. They just need efficient production lines. That means labor costs drop to just 15% to 25% of total manufacturing expenses. Why? Because they’ve optimized everything.The Hidden Labor Behind Quality Control

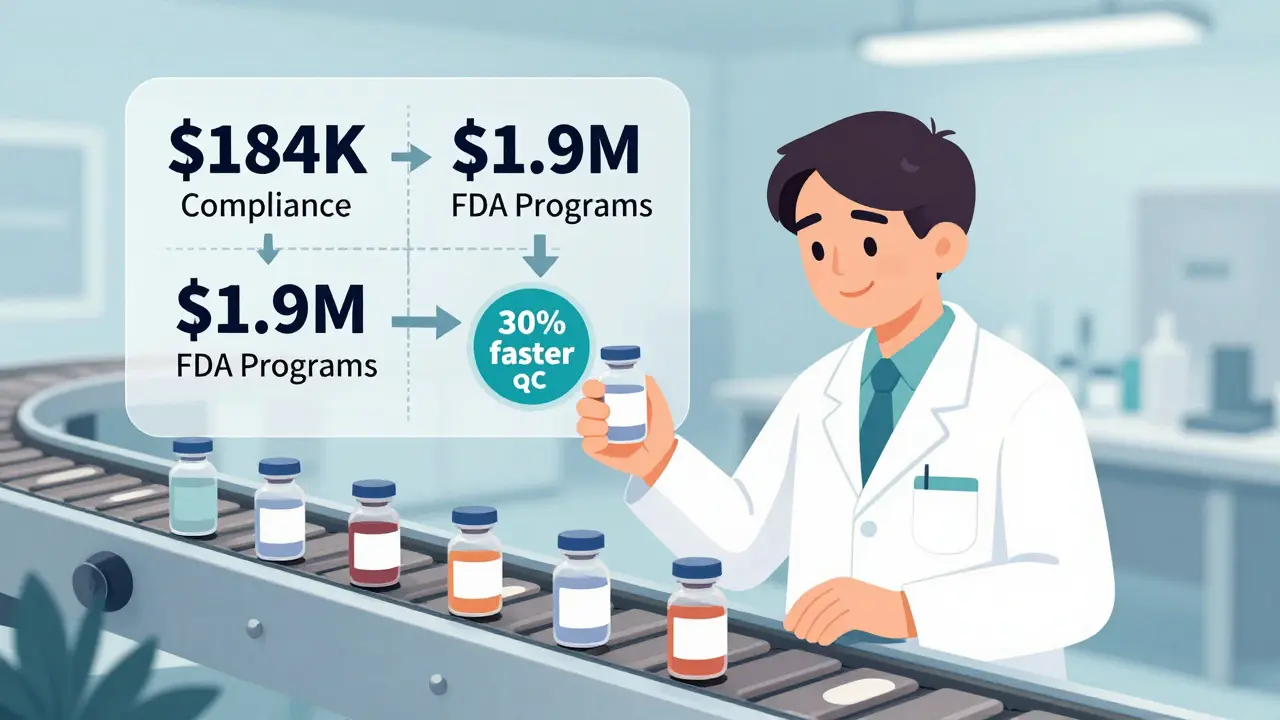

You might think generics are just cheap knockoffs. But that’s not true. The FDA requires generics to meet the same standards as brand-name drugs. That means every batch of a generic drug must be tested for purity, potency, and stability. That testing? It’s done by people. Lots of them. Quality control alone accounts for over 20% of the total cost of producing a generic drug. That’s not just running a machine. It’s trained technicians checking samples, documenting every step, logging results, and ensuring traceability from raw material to finished pill. A medium-sized generic manufacturer spends about $184,000 a year just on compliance systems. Add in the $1.9 million needed to maintain FDA programs and another $320,000 per new drug application, and you’re looking at serious labor investment. But here’s the twist: because generics are made in huge volumes, that labor cost gets spread thin. One lab technician can test 100 batches a week instead of 5. One inspector can oversee 10 production lines instead of one. The per-unit labor cost drops dramatically. BCG’s 2019 study found that when a generic manufacturer doubles its production volume, unit costs fall by 27%. For brand-name drugs, the same increase only cuts costs by 17%. That gap exists because generics benefit from economies of scale in ways brand-name drugs never can.

Where the Work Gets Done

A lot of the labor behind generic drugs happens overseas. About 42% cheaper to produce active pharmaceutical ingredients (APIs) in India or China than in the U.S. That’s not because workers there are more skilled-it’s because labor standards, environmental rules, and wage levels are different. The HHS Office of Planning and Evaluation calls this a structural distortion. It’s not efficiency. It’s cost arbitrage. This doesn’t mean U.S. factories are obsolete. In fact, many U.S.-based generic manufacturers have shifted to contract manufacturing organizations (CMOs). Instead of hiring full-time staff for every step, they outsource production. That turns fixed labor costs into variable ones. If demand drops, they scale back. If demand spikes, they hire more from their CMO partners. It’s leaner. It’s smarter. And it’s why labor costs stay low even when regulations tighten. Brand-name manufacturers, on the other hand, still mostly own their production facilities. They need tight control over their processes, especially for complex drugs like biologics. That means more full-time employees, more training, more oversight. It’s not just labor-it’s infrastructure.Pressure on Labor, Not Just Prices

The more generic competitors enter the market, the lower prices go. And when prices drop, companies have to cut costs. Labor is the easiest place to look. The FDA has warned that this pressure might lead manufacturers to reduce staffing, hire less experienced workers, or cut corners on quality control. That’s not speculation. It’s a documented risk. In 2023, the FDA noted that increasing attention is being paid to whether the push for lower generic drug prices could lead to supply shortages due to cost-cutting. But here’s what most people don’t realize: smart generic manufacturers aren’t cutting labor-they’re investing in it. Companies that train their staff well, invest in prevention (like better process design), and reduce errors end up with lower total costs. Why? Because fewer batches get rejected. Fewer recalls. Faster approvals. Less rework. That’s not about paying less. It’s about paying smarter. One manufacturer that reduced its QC release time by 30% through better training and automation didn’t just save money. They increased their market share. Because they could deliver more product, faster, with fewer disruptions. That’s the real advantage-not low wages, but high efficiency.

What You Pay vs. What It Costs

Let’s break down where your money goes. For every $100 spent on a generic drug:- $36 goes to actual production: ingredients, packaging, labor, logistics

- $18 stays with the manufacturer as gross profit

- $46 goes to distributors, pharmacies, and other middlemen

12 Comments