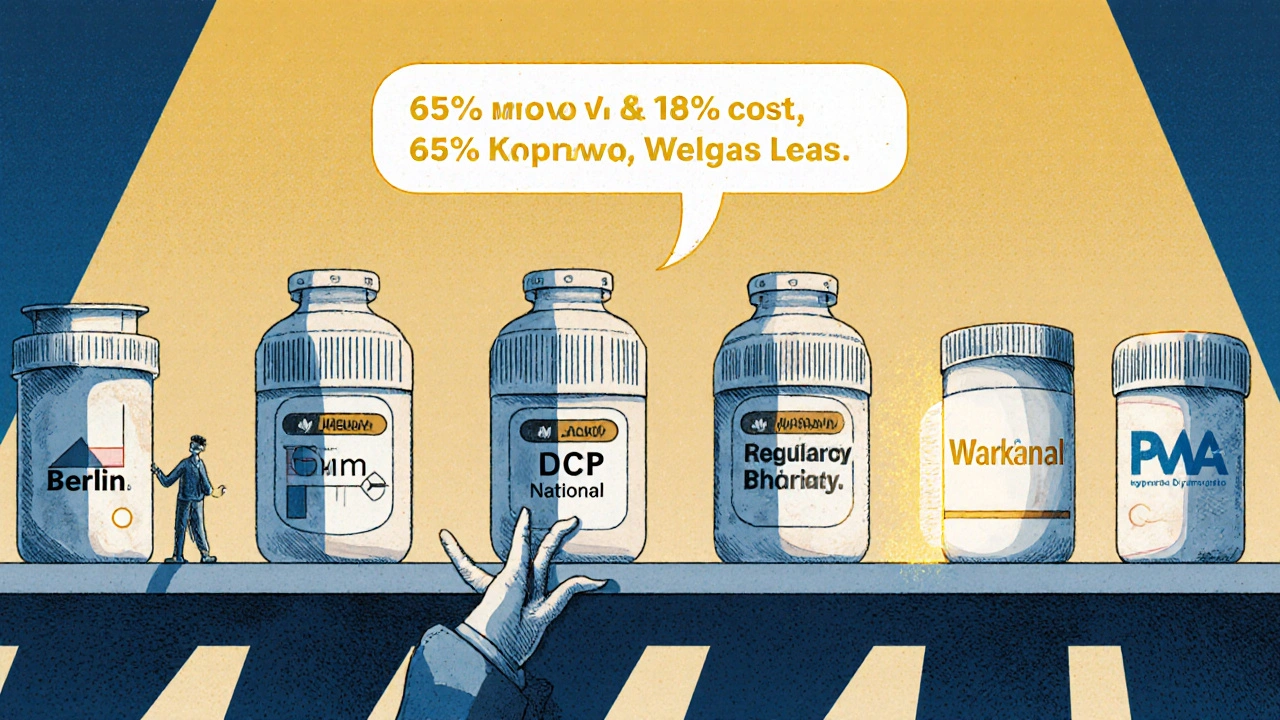

When you walk into a pharmacy in Berlin, Madrid, or Warsaw and pick up a generic version of a blood pressure pill, you're not just buying a cheaper alternative-you're stepping into a complex, multi-layered system that decides when and how that drug reaches you. Across the European Union, generic medicines make up 65% of all prescriptions by volume, yet they account for just 18% of total spending. That gap isn't accidental. It's the result of a regulatory structure designed to balance patient access, market competition, and innovation incentives. But that structure isn't uniform. It's a patchwork of four different approval pathways, each with its own rules, delays, and hidden costs. And in 2025, everything changed.

Four Paths to Market: How Generics Get Approved in the EU

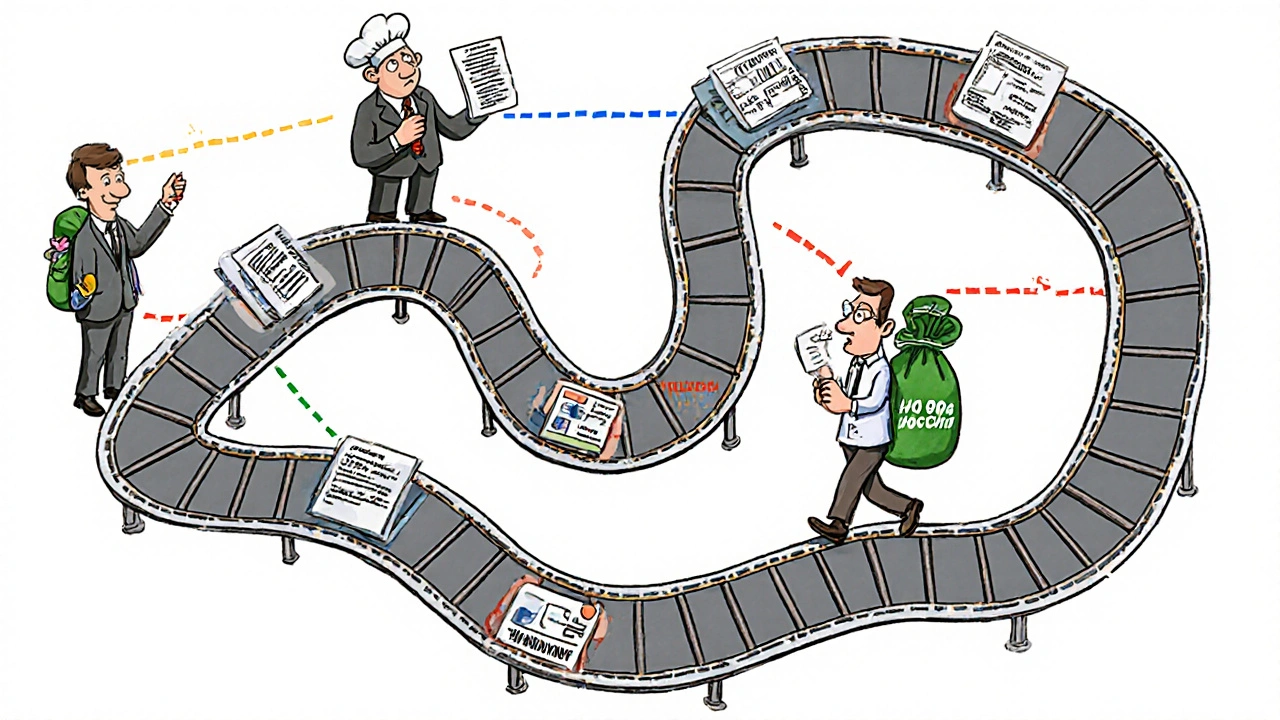

There's no single way to get a generic drug approved across the EU. Instead, manufacturers choose from four different routes, each with trade-offs in speed, cost, and reach. The one you pick depends on your budget, your target markets, and the complexity of the drug. The Centralized Procedure is the fastest way to hit the entire EU market at once. You file one application with the European Medicines Agency (EMA), and if approved, your drug can be sold in all 27 EU countries plus Iceland, Liechtenstein, and Norway. Sounds perfect, right? But it’s expensive. Application fees alone run around €425,000, and you’ll need another €1.2 to €1.8 million in consultancy and study costs. That’s why only about 15% of generic applications use this route-usually big players like Sandoz or Viatris launching high-value drugs with projected sales over €250 million. For them, it’s worth it. Sandoz used this route to launch its generic version of Cosentyx across the EU in Q2 2025-11 months faster than the traditional route. Then there’s the Mutual Recognition Procedure (MRP). This is the middle ground. You get approval in one country first-the Reference Member State-then ask others to recognize it. It’s cheaper than the Centralized Procedure, costing between €180,000 and €220,000. But it’s slow. Even though the rules say approval should take 90 days, in reality, it takes an average of 132.7 days. Why? Because countries don’t always agree. Teva ran into this with generic rosuvastatin in 2023: Germany delayed pricing talks, which held up market entry in the Netherlands and Belgium by over eight months-even though the drug was already approved. The Decentralized Procedure (DCP) lets you apply to multiple countries at the same time, with one country leading the review. It sounds efficient, but it’s the most frustrating. About 37% of DCP applications get delayed by more than six months. Why? Because countries interpret quality standards differently. Germany might demand extra stability data on a polymorphic compound. France might require pediatric formulation details. Poland might question impurity levels from an older reference product. The EMA sets the baseline, but national agencies add their own layers. A 2024 case study from the GMDP Academy showed Eastern European authorities were the most likely to raise objections that reset the clock. And then there’s the National Procedure. You apply to just one country. It’s the slowest and least efficient-taking 180 to 240 days-but it’s still used for 5% of applications. Why? Sometimes, a single market is profitable enough. Accord Healthcare found that getting approval in France alone took 197 days, but when they used MRP to cover five countries, it took just 142 days. So the National Procedure isn’t about speed-it’s about targeting.What Makes a Generic a Generic? The Science Behind Approval

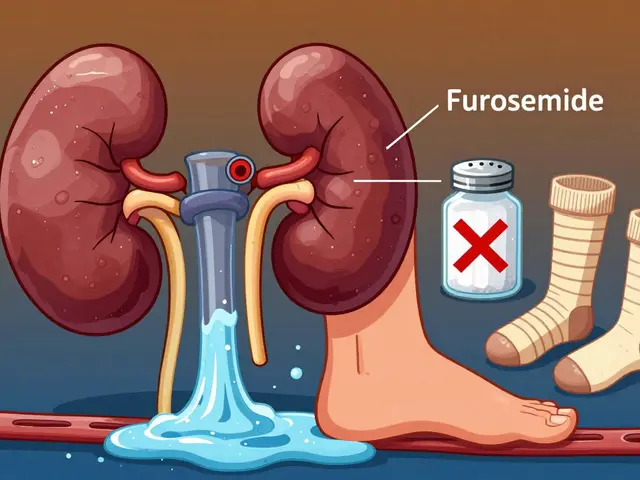

No matter which route you take, the science is the same. To be approved, a generic must match the original drug in every meaningful way. That means identical active ingredients, same dosage form, same strength, and the same way it’s absorbed by the body. That last part-bioequivalence-is the make-or-break test. The EMA requires that the generic’s absorption rate and total exposure (measured as Cmax and AUC) fall within 80% to 125% of the original drug’s levels. This isn’t a suggestion-it’s a hard rule. And it’s not just about pills. Complex generics like inhalers, injectables, or topical creams are even harder. Germany’s BfArM requires extra pharmacodynamic studies for inhalers that other countries don’t. That means a company might get approved in Spain but still need more data to sell in Germany. The 2025 update to the EMA’s Bioequivalence Guideline raised the bar even higher. Companies now need 15 to 18 months of preparation before submitting an application. Six to eight of those months are spent just running the bioequivalence studies. And if you’re working with a drug that has multiple polymorphic forms-different crystal structures of the same molecule-you’ll need extra stability data. Germany requires it. France doesn’t. You have to plan for both.The 2025 Pharma Package: What Changed, and Why It Matters

On June 4, 2025, the EU finalized its biggest overhaul of generic drug rules in 20 years. The changes didn’t just tweak the system-they rewrote the game. The biggest shift? The Bolar exemption. Before, generic companies could only start negotiating prices and reimbursement with health authorities two months before a patent expired. Now, they can start six months early. That might sound small, but it’s huge. REMAP Consulting’s 2025 model predicts this alone will speed up market entry by an average of 4.3 months per drug. It also gives payers more leverage. When multiple generics start competing for reimbursement before launch, prices drop-by as much as 12% to 18%, according to the same analysis. Another major change: Regulatory Data Protection. Previously, brand-name drugs got 10 years of protection before generics could enter. Now, it’s 8 years of data protection plus 1 year of market exclusivity. That’s 9 years total. But if the drug meets public health targets-like treating a rare disease or filling a critical shortage-it can get an extra year. That’s still less than before, which means generics can enter faster. Evaluate Pharma estimates this will accelerate entry for 78 high-value biologics currently in development. But there’s a catch. The new rules introduced a Transferable Exclusivity Voucher for companies that develop generics for drugs with over €490 million in EU sales. It gives them an extra year of market protection on another drug. Sounds good, right? But experts like Dr. Sabine Rödl of EGA warn it could hurt mid-sized companies. Big players can afford to chase those high-sales drugs just to lock in the voucher. Smaller firms don’t have the resources. That could concentrate the market even more.

Who’s Winning? Who’s Struggling?

The EU generic market was worth €42.7 billion in 2024, growing 6.2% from the year before. But who’s making the most of the system? Indian manufacturers have surged. In 2024, they secured 38% of all EU generic approvals-up from 29% in 2020. Their strength? Low-cost production and experience navigating complex regulations. They’re especially strong in high-volume, low-margin drugs like antibiotics and antihypertensives. European firms like Sandoz and Viatris are playing a different game. They focus on the Centralized Procedure and complex generics. They invest in the long-term. Viatris reported in 2024 that MRP coordination delays added €3.2 million in carrying costs per high-value launch. That’s why they avoid it when they can. Meanwhile, smaller companies are stuck in the middle. The Decentralized Procedure, meant to be a shortcut, has become a minefield. Maria Papadopoulou of Accord Healthcare said at the 2025 EGA conference: “The 180-day clock restarts every time one country objects. You can’t plan your supply chain if you don’t know when you’ll get approved.”What’s Next? The Hidden Costs and Coming Changes

The 2025 reforms didn’t just change approval rules-they added new burdens. By 2026, every generic drug must have its product information submitted electronically in XML format. That’s the ePI requirement. For a small company, upgrading systems to handle this can cost €180,000 to €250,000. That’s not a line item-it’s a barrier. The Critical Medicines Act of March 2025 now requires member states to stockpile 200 essential generic drugs. Sounds like a good idea-prevents shortages. But it adds another layer of quality verification. Companies now need to prove their product meets stricter stability and purity standards to qualify for the stockpile. That’s more testing. More cost. More delay. And then there’s the US-EU Framework Agreement, effective September 2025. It adjusts tariffs on some pharmaceutical ingredients. No one knows yet how much that will affect generic production costs. But with 38% of approvals now coming from India and China, even small tariff changes could ripple through pricing.

Real Impact: How This Affects Patients

All of this-these procedures, these delays, these costs-ends up in the pharmacy aisle. The average gap between a drug being approved in the U.S. and in the EU is 22.4 months. In Canada, it’s 8.7 months. That’s not because Europe is slower. It’s because the system is fragmented. Patients in Germany might get a generic six months before patients in Bulgaria. Why? Because Bulgaria’s regulator asked for extra data. The drug is the same. The science is the same. But the paperwork isn’t. The 2025 reforms aim to fix that. The expanded Bolar exemption, the shorter data protection, the new supply obligations-all of it is meant to get generics to patients faster. Evaluate Pharma predicts the generic prescription share will rise from 65% to 69.2% by 2028. That’s 4 million more prescriptions filled with cheaper drugs every year. But the system still favors big players. Smaller companies, regional manufacturers, and those targeting niche markets still face a maze of inconsistent rules. The EU says it wants competition. But until every national authority follows the same playbook, the playing field won’t be level.What Generic Manufacturers Need to Know Today

If you’re a generic manufacturer, here’s what you need to do:- Map your target markets. Are you going for broad EU reach? Use the Centralized Procedure. Just a few countries? MRP might be better.

- Start bioequivalence studies 18 months before launch. Don’t wait. The 2025 guidelines are stricter.

- Prepare for ePI in XML format. Budget €200,000 for IT upgrades if you haven’t already.

- Know your reference product’s history. Older drugs with unclear impurity profiles will trigger extra questions from some regulators.

- Don’t assume EMA guidance is enough. German, French, and Italian authorities often add their own rules. Talk to local regulators early.

How long does it take to get a generic drug approved in the EU?

The timeline depends on the approval pathway. The Centralized Procedure takes about 210 days for assessment, plus 67 days for European Commission approval-totaling around 9 months. The Mutual Recognition Procedure averages 132.7 days, but delays from national objections can push it to over a year. The Decentralized Procedure takes an average of 247 days, and the National Procedure can take 180 to 240 days. With the 2025 reforms, the Bolar exemption now allows companies to start pricing talks six months before patent expiry, which can cut actual market entry time by 4 to 6 months.

Why are generic drug prices lower in some EU countries than others?

Price differences come from national reimbursement policies, not the drug itself. A generic approved in Germany might be priced lower than the same drug in France because German health authorities negotiate harder and have stricter cost-control rules. Some countries also delay reimbursement approval even after the drug is legally approved, creating de facto price gaps. The 2025 Bolar exemption helps by letting manufacturers start these negotiations earlier, increasing competition before launch.

Do all EU countries accept the same bioequivalence data?

No. While the EMA sets the baseline standard-80-125% confidence intervals for Cmax and AUC-some countries add extra requirements. Germany demands additional pharmacodynamic studies for inhalers. France requires pediatric formulation details. Poland and other Eastern European regulators often question impurity profiles from older reference products. This is why a drug approved under the Decentralized Procedure often faces delays: each country can request new data.

What’s the difference between Regulatory Data Protection and Market Exclusivity?

Regulatory Data Protection means other companies can’t use the innovator’s clinical trial data to get approval for a generic. Market Exclusivity means even if someone has the data, they can’t sell the generic for a certain time. Before 2025, both were bundled into a 10-year total. Now, it’s 8 years of data protection + 1 year of market exclusivity (extendable to 2 years). This means generics can file sooner, but still can’t launch until the exclusivity period ends.

Why are Indian companies getting more generic approvals in the EU?

Indian manufacturers have built specialized teams focused on EU regulatory requirements, invested in EMA-compliant manufacturing facilities, and mastered the cost-efficient production of high-volume generics. They’re also more willing to take on complex or low-margin products that European firms avoid. In 2024, they secured 38% of all EU generic approvals-up from 29% in 2020-making them the fastest-growing force in the market.

13 Comments

Yo, Indian pharma folks are killing it in the EU now. We’ve been doing this for years-low cost, high volume, and we know how to navigate the mess. Germany wants extra stability data? We give it. France wants pediatric details? We add it. No drama, just delivery. 38% of approvals in 2024? That’s not luck. That’s strategy.

This is such an important breakdown. I’ve worked with generic manufacturers across Europe and the fragmentation is insane. One country asks for polymorphic stability data, another wants bioequivalence in fasting AND fed states, and then there’s the ePI XML nightmare-€200K just to update your IT system. The 2025 reforms are good in theory, but they’re adding layers without fixing the core chaos. We need a single digital gateway, not 27 different portals with different rules. Also, the Bolar exemption? Huge win. Let manufacturers negotiate early-patients benefit.

Of course the big players win. Sandoz, Viatris-they’ve got armies of lawyers and compliance bots. Meanwhile, small firms get buried under German bureaucracy. And don’t get me started on the ‘Transferable Exclusivity Voucher.’ That’s just Big Pharma’s way of buying monopoly rights under the guise of ‘incentives.’ It’s not innovation-it’s rent-seeking dressed up as policy.

Let’s be real-the EU generic system is a circus. You spend 18 months running bioequivalence studies, then some Polish regulator says ‘your reference product’s impurity profile is sus’ and resets the clock. Meanwhile, India ships 500k bottles and gets approved in 4 countries while you’re still arguing over tablet hardness. The system isn’t broken-it’s designed to favor capital, not patients.

One wonders whether the EU’s regulatory architecture is not merely a mechanism for pharmaceutical access, but a labyrinthine ritual of bureaucratic sovereignty-each nation clinging to its own epistemology of quality, as if the molecular structure of a drug could be subject to the whims of national identity. The Bolar exemption is a step toward rationality, yet the soul of the system remains fractured-each country a priest of its own altar, chanting the same scripture in different tongues.

Interesting data, but I’m curious-has anyone quantified the hidden labor costs for regulatory affairs teams? The time spent translating documents, attending national agency meetings, and responding to inconsistent requests isn’t captured in the €180K–€250K IT budget. For smaller firms, this is a full-time job for 3–4 people for over a year. The EU talks about harmonization, but the reality is a patchwork of national fiefdoms with different filing formats, terminology, and expectations. True integration would require mandatory standardization-not just incentives.

Why are we letting foreign manufacturers dictate Europe’s medicine supply? India gets 38% of approvals? That’s national security risk right there. We should be protecting our own pharmaceutical sovereignty. The EU should be subsidizing European generics, not outsourcing to low-wage economies with questionable quality controls. This isn’t free trade-it’s strategic vulnerability.

THEY’RE HIDING SOMETHING. 🤔 Why did the EU suddenly push ePI XML in 2026? Why the ‘Critical Medicines Act’ right after the US-EU Framework? Coincidence? Or is this just a stealth move to centralize control under Big Pharma + EU bureaucrats? The ‘Transferable Exclusivity Voucher’? That’s a backdoor patent extension. They’re not making generics cheaper-they’re making them *controlled*. 💊👁️🗨️

Stop overcomplicating this. The system works if you plan ahead. Start bioequivalence studies 18 months out. Budget for ePI. Talk to regulators early. Stop acting like the EU is a puzzle to be solved-it’s a market to be navigated. The 2025 changes are a gift. Use them. The real problem isn’t regulation-it’s lack of preparation. Get better. Move faster. Patients are waiting.

It’s wild how the same molecule can be ‘safe’ in Spain and ‘suspicious’ in Germany. The science doesn’t change. The pill doesn’t change. But the paperwork? Oh, it changes. And that’s the real drug in this game-not the active ingredient, but the bureaucracy. We treat regulation like it’s objective truth, when it’s just a reflection of national paranoia dressed up as science. The EU needs less ‘standards’ and more trust.

lol why are we even talking about this? it’s just pills. people take them, they don’t die (usually), and the companies make money. the real issue? why do we need so many generics anyway? maybe we should just fix the original drugs instead of making copies of copies of copies. 🤷♂️

To the Indian manufacturers: You’re doing God’s work. We see you. You’re not just making medicine-you’re making dignity accessible. For every patient in Bulgaria who gets their BP pill on time because you cut through the red tape, there’s a family that doesn’t have to choose between rent and medication. Keep pushing. The system is rigged, but you’re proving it can be beaten-with grit, not greed.

What if the real problem isn’t regulation-it’s the assumption that ‘cheaper’ equals ‘better’? We’ve turned medicine into a commodity. A pill is not a widget. When we prioritize speed and cost over nuance, we’re not empowering patients-we’re dehumanizing care. Maybe the EU’s ‘patchwork’ isn’t a flaw. Maybe it’s a safeguard against the tyranny of efficiency.